Gratuity Calculation: How much money will you get on 60 thousand salary, how to check gratuity? Know what is the formula

Gratuity Calculator: Employees are given the benefits of other allowances along with their salary. One of these is gratuity. Employees who have worked with a company or employer for a fixed period are given the benefit of gratuity after retirement. The amount of gratuity an employee will receive is calculated on the basis of many circumstances. The years of employment and the amount of salary play an important role in this. Let us know how the gratuity of employees is checked...

The Kalamkar News, Digital Desk: Every employed person gets various types of allowances along with salary. One of these allowances is gratuity , which is given in return for working with a company or employer for a certain period of time. Although all employees are entitled to gratuity, there is a lot of difference in the rules. In such a situation, the question arises that how much salary does the employer pay as gratuity.

What is gratuity?

Gratuity (what is gratuity) is the amount which is given to an employee by the company as a reward in return for providing better services for a long time. According to its rules, if a person works in a company continuously for 5 years, then he becomes entitled to receive gratuity. The amount of gratuity to be received is calculated on the basis of a certain formula.

Big update on PPF and Sukanya Samriddhi Yojana

If a person earns Rs 60,000 per month and has worked in a company for 10 consecutive years, how much money will he get? Let us understand the calculation based on the formula.

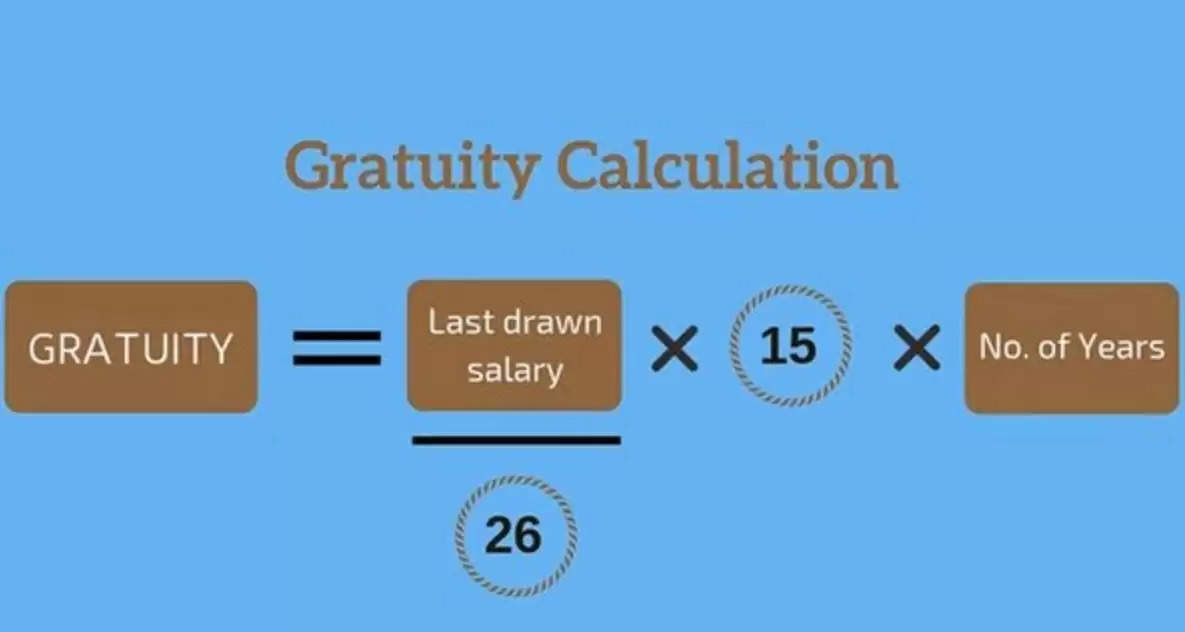

Formula to calculate gratuity

The formula to calculate gratuity is – (last salary) x (number of years worked in the company) x (15/26). Last salary means the average of your last 10 months' salary. Basic salary, dearness allowance and commission are included in this salary. Due to 4 Sundays being week off in a month, 26 days are counted and gratuity is calculated on the basis of 15 days.

Understand with an example - If you have a salary of Rs 60,000 and 10 years of service, how much will be the gratuity?

If you have a salary of Rs 60,000 and a job for 10 years, then how much will be the gratuity amount ? According to the formula, its calculation will be like this - (60,000) x (10) x (15/26) = Rs 3,46,153. According to the formula, this amount will be given to you as gratuity by the company. Whereas if a person's salary is Rs 60,000 but he has worked for only 5 years, then how much gratuity will he get? In such a situation, according to the formula, the calculation will be on the basis - (60,000) x (5) x (15/26) = Rs 1,73,076 will be given as gratuity. According to the rules, gratuity cannot be given more than Rs 20 lakh.

Know these rules related to gratuity

According to the Gratuity Act 1972 , if an employee dies or becomes disabled due to an accident and is unable to work again, then the rule of working for 5 years for payment of gratuity does not apply. . In such a situation , the gratuity amount is paid to the nominee or dependent .

For information, let us tell you that while joining the job, you can register the name of nominee for your gratuity amount by filling Form F. Whereas if an employee has worked in a company for 4 years and 8 months, then his employment period is considered to be 5 years. In such a situation, he is given the amount of gratuity according to 5 years.